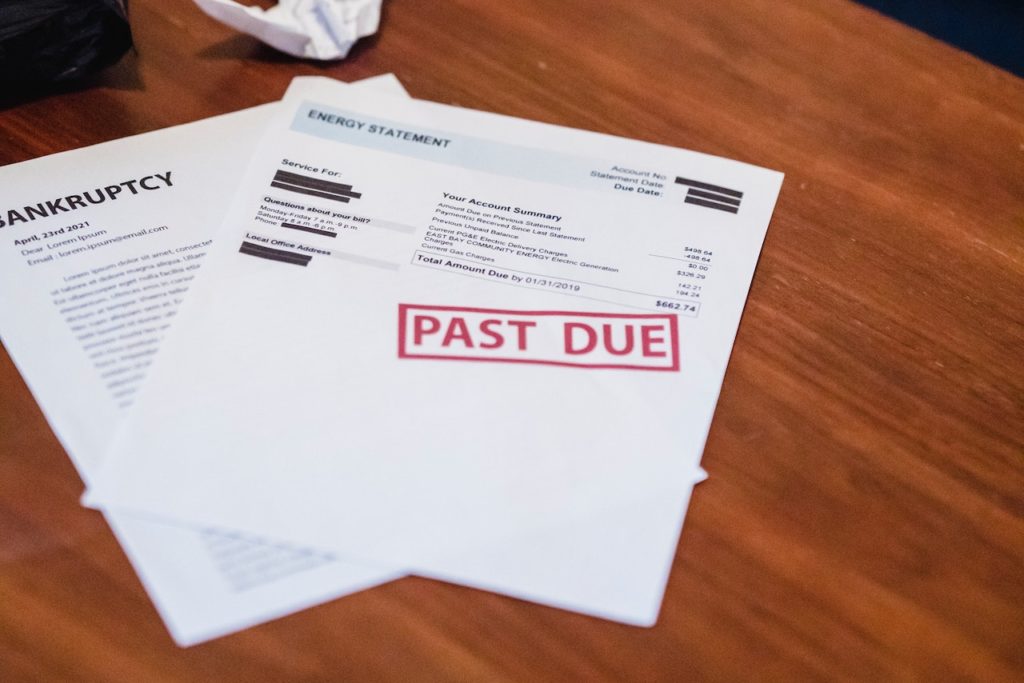

Navigating Chapter 13 Bankruptcy: Strategies for Success

Filing for bankruptcy can be a difficult and overwhelming experience. Chapter 13 bankruptcy, also known as reorganization bankruptcy, is a legal process that allows a person to restructure their debt and repay it over a period of time, usually three to five years. While this process can be challenging, there are several tips and strategies that can help you survive Chapter 13 bankruptcy and come out on the other side with a fresh start:

Understand the Chapter 13 Process

Before filing for Chapter 13 bankruptcy, it’s essential to understand the process. Chapter 13 bankruptcy allows you to keep your assets while restructuring your debt. You will work with a bankruptcy trustee and your creditors to create a repayment plan, which will typically last three to five years. During this time, you will make monthly payments to your trustee, who is tasked to remit the funds to your creditors.

Hire an Experienced Bankruptcy Attorney

Filing for Chapter 13 bankruptcy can be complicated, and it’s crucial to have an experienced bankruptcy attorney on your side. A knowledgeable attorney can help you navigate the process, negotiate with creditors, and ensure that your rights are protected. They can also help you create a feasible repayment plan that meets your needs and budget.

Develop a Realistic Budget

Creating a realistic budget is essential when filing for Chapter 13 bankruptcy. You will need to show the bankruptcy court that you can afford to make your monthly payments under the repayment plan. Your budget should include all of your expenses, such as housing, utilities, food, transportation, and medical costs. Be sure to include any debt payments that you will be making under the repayment plan.

Stick to Your Repayment Plan

Once your repayment plan is in place, it’s crucial to stick to it. Missing payments or failing to make payments on time can result in your case being dismissed, which could lead to foreclosure or repossession of your assets. Make your payments on time and communicate with your bankruptcy trustee if you encounter any financial difficulties.

Avoid New Debt

While you are under Chapter 13 bankruptcy, it’s crucial to avoid taking on new debt. This can include credit cards, personal loans, or other types of financing. Any new debt could jeopardize your repayment plan and may result in your case being dismissed.

Build an Emergency Fund

Building an emergency fund is crucial when you are under Chapter 13 bankruptcy. Unexpected expenses can arise, such as medical bills or car repairs, and having an emergency fund can help you avoid taking on new debt. Aim to save at least three to six months’ worth of living expenses.

Communicate with Your Bankruptcy Trustee

Your bankruptcy trustee is responsible for overseeing your case and ensuring that your creditors are paid according to the repayment plan. It’s crucial to communicate with your trustee if you encounter any financial difficulties or if your circumstances change. Your trustee can work with you to modify your repayment plan if necessary.

Stay Positive

Filing for Chapter 13 bankruptcy can be a challenging experience, but it’s essential to stay positive and focused on the future. Remember that bankruptcy is a tool to help you get back on track financially, and it’s not a reflection of your worth as a person. By staying positive and focused, you can emerge from bankruptcy with a fresh start and a brighter financial future.

Regaining Financial Success

Surviving Chapter 13 bankruptcy requires careful planning, budgeting, and communication with your trustee. By following the above tips and strategies, you can successfully navigate the bankruptcy process and emerge with a fresh start. Remember, bankruptcy is a tool to help you get back on track financially, and with diligence and perseverance, you can move forward with confidence.

If you need a bankruptcy attorney in Dallas, turn to Angela R. Owens, an experienced debt defense lawyer serving Plano, Allen, Frisco, Dallas, and the surrounding area. Schedule a free consultation.